1.How to claim tax refunds on purchases?

In South Korea, Malaysia, Singapore, Australia, and EU countries, cardholders can claim tax refunds when they have met the minimum purchase for a tax refund required by the nation concerned at merchants with logos of the following tax refund agencies. Cardholders must also fill out tax refund forms (name, passport No., address, etc.) correctly under the clerk’s guidance in order to get refunded.

2.Do tax refund forms need to be stamped by customs?

Tax refund forms must be stamped by customs. Tax refund forms without the stamp of customs will be deemed invalid and cannot be used to claim tax refunds. Goods departing from EU territory shall be examined by customs, and the tax refund forms shall be stamped by EU customs. It should be noted that the tax refund forms of Switzerland need to be affixed with the stamp of Swiss customs.

3.Can I use my UnionPay card for a tax refund if I haven’t paid with the UnionPay card when shopping at stores?

Yes, you can. A tax refund form issued by a store generally will provide three options for tax refunds, namely, bank cards, cash and cheques. To use a UnionPay card for a tax refund, you only need to fill in your UnionPay card number(see the picture below). You may tell the attendant at the airport’s tax refund counter that you are using a UnionPay card to claim a tax refund.

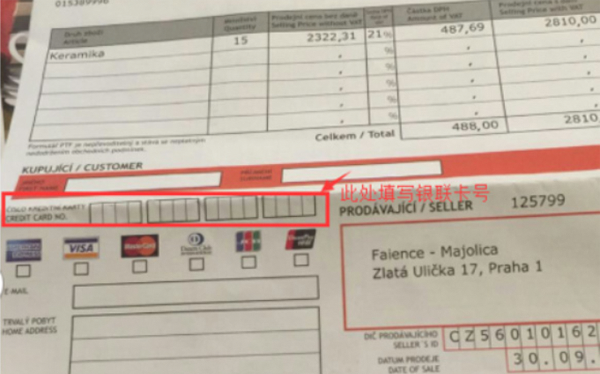

A sample of a tax refund form of Fintrax:

1.Fill in your Unionpay card number at the red box

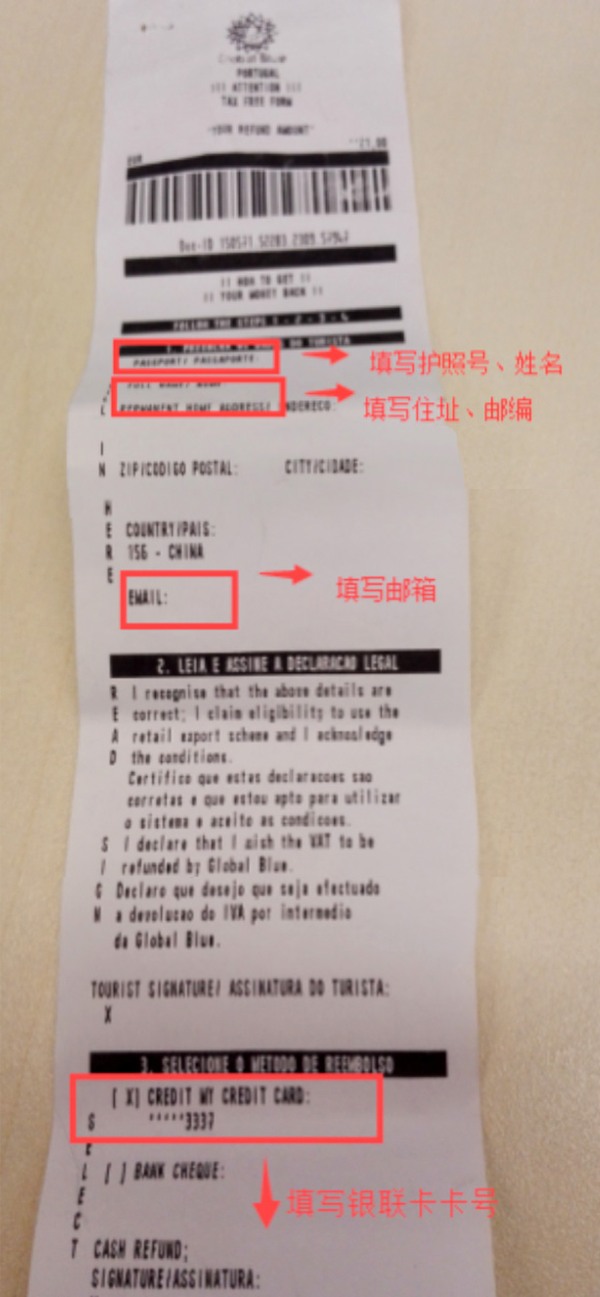

A sample of a tax refund form of GlobalBlue:

1.Fill in your name and passport number at the red box

2.Fill in your address and Zip code at the red box

3.Fill in your email at the red box

4.Fill in your Unionpay card number at the red box

4.Can both UnionPay debit cards and credit cards be used for claiming tax refunds on purchases?

Yes. All UnionPay debit cards and credit cards (card number starts with 62) can be used for claiming tax refunds on purchases. Generally, the bank card column on tax refund forms is marked with “Credit Card”. However, no matter this blank is filled with the number of a UnionPay debit card or credit card, the refund will be transferred to the corresponding account.

5.Can UnionPay cards be used for claiming tax refunds if no UnionPay logo or word appears on the tax refund forms?

Yes. Although in some countries, the UnionPay logo or words are not printed on tax refund forms due to system reasons, you can still fill in your UnionPay card number to claim tax refunds on the forms of tax refund agencies cooperating with UnionPay.

6.How can I inquire the processing status of a tax refund after claiming it (only with UnionPay cards issued within the Chinese Mainland)?

Currently, inquiries can be made via Union Pay Wallet. You may obtain the information about the processing status of tax refunds by scanning the following QR code, and accessing "UnionPay Wallet Client—Life Channel—Tax Refund Inquiry".

7.Can purchased goods for tax refund be used immediately?

No. Purchased goods cannot be opened or used until they are examined by customs before departing from the territory.

8.Do I need to put all the purchased goods for tax refund in my hand luggage?

Yes. If the goods are too large to carry on an airplane, you may put them with your checked luggage after the goods are examined by customs. Customs may refuse to stamp or confirm your tax refund information if the goods are not inspected by the customs.