Asia-Pacific

Singapore

Singapore

UnionPay Tax Refund Tips:

Tax Refund Steps:

1. Purchase

When making purchases at merchants posted with eTRS logo, please use the same credit card to serve as the voucher for all purchases. When spending over S$100 (about 498 RMB), please get the eTRS receipts and original invoices/receipts from the merchants. If a merchant is not a member of eTRS system, ask the merchant for a Tax Refund Form and complete and sign on it. Please retain the original invoices/receipts after purchase.

2.Pre-departure tax refund via eTRS system/Tax Refund Form

If you need to carry about any good purchased, please have it registered before heading for the Transit Lounge (behind the Departure Hall). To get the tax refund for purchased goods and services issued with eTRS receipt, please go to the eTRS self-help service counter. If you hold a Tax Refund Form, please go through the tax refund procedure at the Customs Inspection Counter.

eTRS Self-help Tax Refund

At the eTRS self-help service counter, please use the designated credit card as the

voucher for retrieval of purchase details;

or you can also scan your eTRS receipts to retrieve all purchases, and then apply for

tax refund for goods and services according to eTRS's instructions. You may be required

to present your purchased goods at the Customs Inspection Counter.

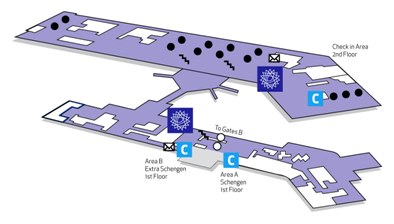

The eTRS self-help service counters, located at the Departure Hall (before going through

the departure procedure) and the Departure Transit Lounge in Terminal 1, 2 and 3 (after

going through the departure procedure) of Changi Airport, are open throughout the day;

-

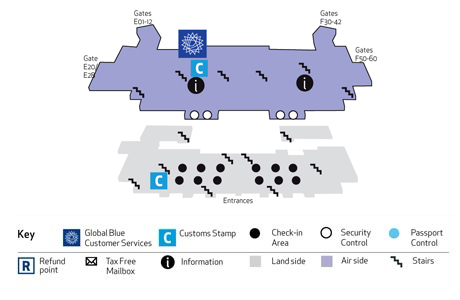

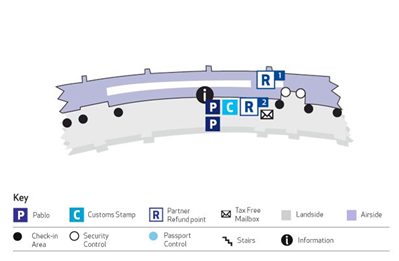

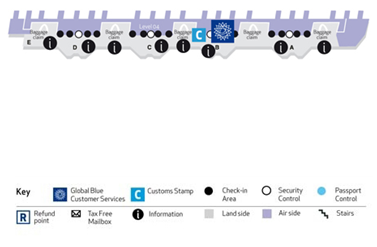

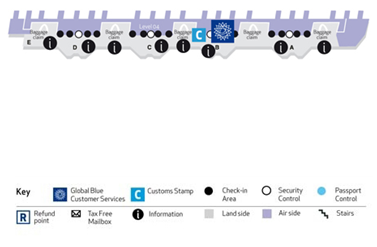

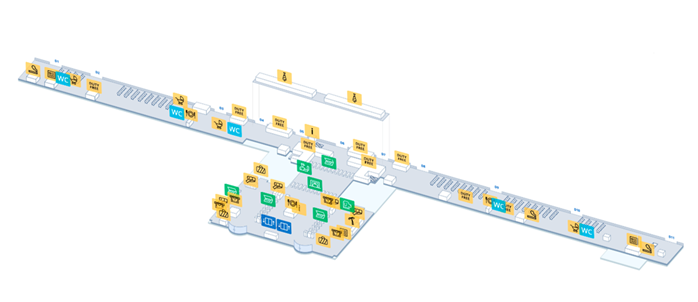

Changi Terminal 1

-

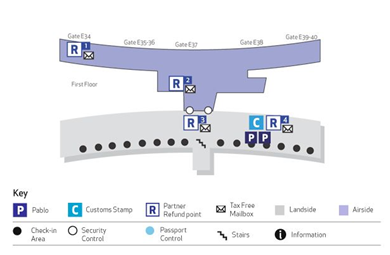

Changi Terminal 2

-

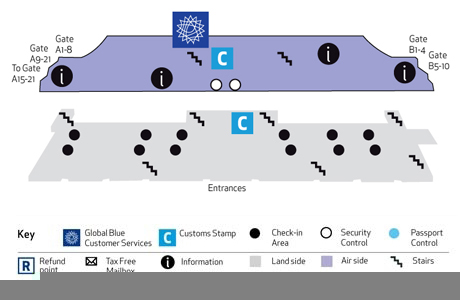

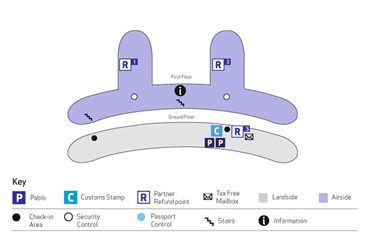

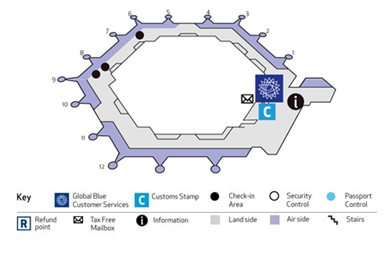

Changi Terminal 3

Tax Refund via Tax Refund Form

To get the tax refund by using Tax Refund Form issued by Global Blue or Global tax free, please present the Tax Refund Form to the Customs Inspection Counter for stamping and having purchased goods inspected.Note: No Customs stamp, no tax refund

Claim the refunded tax:

-

If you select the option of credit card for receiving tax refund at eTRS

Self-help counters, you can get on board directly without going through any

procedure;

If you select the option of credit card for receiving tax refund at eTRS

Self-help counters, you can get on board directly without going through any

procedure;

-

If you choose to receive the tax refund in cash, please get the refunded cash at

the Central Refund Counter in the Transit Lounge (behind the Departure Hall);

If you choose to receive the tax refund in cash, please get the refunded cash at

the Central Refund Counter in the Transit Lounge (behind the Departure Hall);

-

If you hold a Tax Refund Form issued by Global Blue or Global tax free, please

submit the form to, and get the refunded cash from, the tax refund office at the

Transit Lounge (behind the Departure Hall) after having the form stamped at the

Customs Inspection Counter;

If you hold a Tax Refund Form issued by Global Blue or Global tax free, please

submit the form to, and get the refunded cash from, the tax refund office at the

Transit Lounge (behind the Departure Hall) after having the form stamped at the

Customs Inspection Counter;

-

If you hold a Tax Refund Form under the tax refund plan independently developed

by the merchant, please post the form into the mailbox at airport. The form will

be sent to the relevant merchant for processing.

If you hold a Tax Refund Form under the tax refund plan independently developed

by the merchant, please post the form into the mailbox at airport. The form will

be sent to the relevant merchant for processing.

-

If using Tourego app to apply for tax refund, the tax refund will be credited to

the designated UnionPay card. After returning home, you can log on Tourego app

or UnionPay international official website / wechat account to check the

progress of tax refund.

If using Tourego app to apply for tax refund, the tax refund will be credited to

the designated UnionPay card. After returning home, you can log on Tourego app

or UnionPay international official website / wechat account to check the

progress of tax refund.

South Korea

South Korea

UnionPay Tax Refund Procedure:

1. Complete the Tax Refund Form on purchase, choose credit card for receiving tax refund and fill in UnionPay card ( card number starting with 62).

2. Before departure, go to Customs Office for stamping.

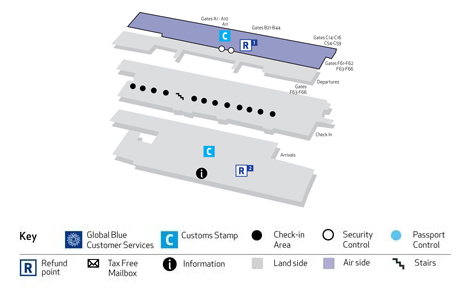

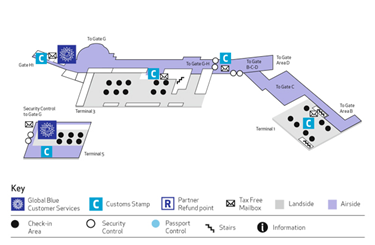

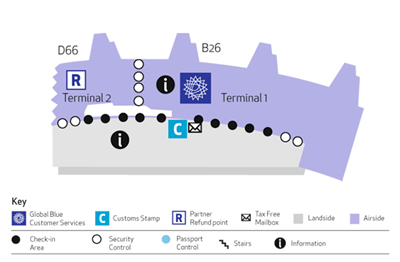

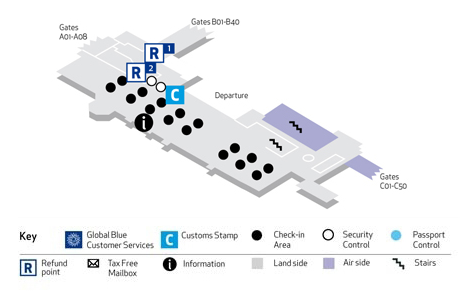

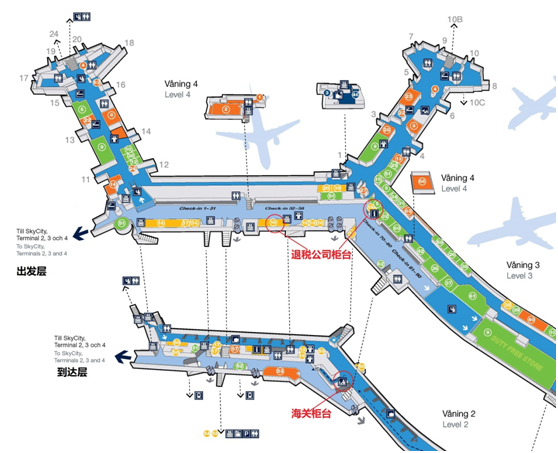

For example: at Incheon International Airport, Korea, the Customs Office is located at: Before Security Control - two Customs Stamps, each opposite Check-in Counter D and J on F3 of the Terminal; After Security Control - four Customs Stamps, each at Gate 1, 2, 3 and 4, for stamping and inspecting tax refund articles carried at hand.

3. When you get to the left side of LV store near Gate 28 after stamping, you will see the Tax Refund Counters of the two tax refund companies (Global Tax Free and Global Blue) having cooperation with UnionPay, please put the Tax Refund Envelope into the mailbox.

-

-

Incheon Airport

UnionPay Tax Refund Tips:

-

Tax refund at Incheon International Airport, Korea: If the

amount of tax refund is less than KRW 75,000.00 (counted as purchasing amount between

KRW 30,000 and KRW 2 million, about RMB 160~RMB 10,070), you may get tax refund at the

Self-help Kiosk.

Tax refund at Incheon International Airport, Korea: If the

amount of tax refund is less than KRW 75,000.00 (counted as purchasing amount between

KRW 30,000 and KRW 2 million, about RMB 160~RMB 10,070), you may get tax refund at the

Self-help Kiosk.

Tax Refund Kiosk at Incheon International Airport

How to use:

- 01 Scan your passport and Tax Refund Form at Tax Refund Kiosk in the departure lounge of Incheon International Airport.

- 02 The tax refund machine displays the verification result, next step tips, and whether Customs scanning is required.

- 03 Get the tax refund at Tax Refund Kiosk by selecting UnionPay card (card number starting with 62) for receiving tax refund.

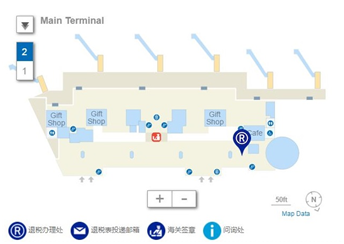

Taiwan China

Taiwan China

UnionPay Tax Refund Tips:

- Please arrive at

the airport or port three (3) hours in advance and go through tax refund and other departure

procedures at eTRS Self-help Kiosk or Tax Refund Service Counter.

- Before luggage checking,

scan your entry certificate and Tax Refund Particulars Application Form at eTRS Self-help Kiosk

or Tax Refund Service Counter. The tax refund system will display whether the goods must be

inspected by the Customs. Where no such inspection is required, you may go through the tax

refund procedure at Tax Refund Kiosk or Tax Refund Service Counter.

- UnionPay Credit

Cardholders could apply for Downtown Early Refund with the credit card as guarantee, but if

cardholders do not complete the requested process afterwards, the tax refund agency would have

the rights to debit the refunded amount from the card.

Tax Refund Steps:

1. Make purchases and apply to merchants for Tax Refund Form

For cumulative UnionPay card purchases over NT$2,000.00 (including tax) in the same selected store posted with foreign passenger shopping tax refund logo on the same day, the cardholder may carry his/her entry certificate and apply to the store salesperson for the issuance of a Tax Refund Form on the day of purchase.

2. Complete the tax refund procedure at Tax Refund Kiosk/Tax Refund Service Counter of airport/port.

Within ninety (90) days after the date of purchase, UnionPay cardholders may go through the tax refund procedure at Tax Refund Kiosk/Tax Refund Service Counter (before luggage checking at departure) by carrying their Taiwan Entry Permit, tax refund goods, invoices, and Tax Refund Particulars Application Form, and select UnionPay card for receiving tax refund.

Locations for application for tax refund

| Address | Location |

|---|---|

| Taipei International Airport | Customs Tax Refund Service Counter |

| Taiwan Taoyuan International Airport Terminal 1 | Customs Service Counter on F1 of Departure Hall |

| Taiwan Taoyuan International Airport Terminal 2 | Customs Service Counter on F3 of Departure Hall |

| Taichung Airport | Customs Service Center |

| Kaohsiung International Airport | Tariff Bureau Passenger Service Center on F3 |

| Hualien Airport | Passenger Service Center on F1 |

| Taiwan International Ports Logistics Corporation Keelung Branch | East No.2 Wharf and West No.2 Wharf |

| Taiwan International Ports Logistics Corporation Taichung Branch | Customs Service Counter at Passenger Service Center |

| Taiwan International Ports Logistics Corporation Kaohsiung Branch | 3/F of Passenger Terminal Building |

| Taiwan International Ports Logistics Corporation Hualien Branch | Passenger Service Center on F1 |

| Kinmen Waterhead Wharf | Customs Tax Refund Service Counter |

3. During tax refund procedure at airport, the system will display whether Customs inspection is required.

Upon inspection, Tax Refund Service Counter or eTRS Self-help Kiosk will print the tax refund particulars verification sheet for the UnionPay cardholder as receipt. After successful completion of the above steps, UnionPay will remit the tax refund to the cardholder's designated UnionPay card account within 5-10 working days.

Australia

Australia

UnionPay Tax Refund Steps:

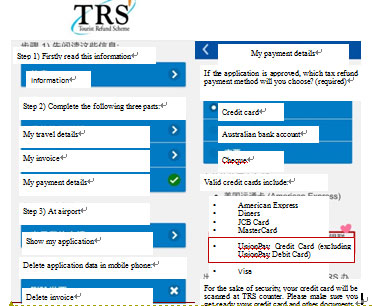

1. Get the tax invoice upon purchase over AUD 300.00 at the same merchant.

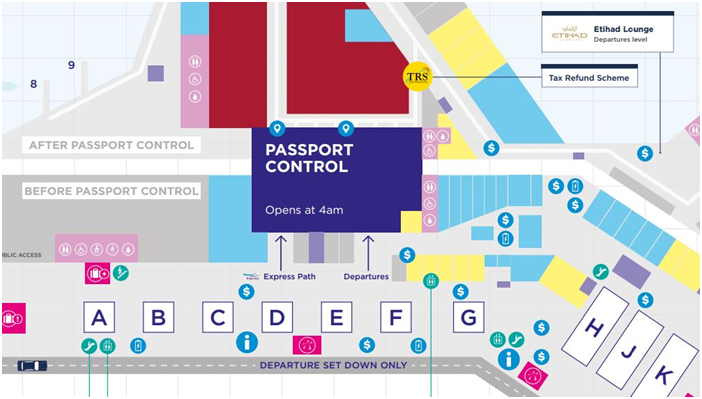

2. Before departure, go through the tax refund procedure at TRS Facility by carrying your tax refund goods, tax invoice, passport and boarding pass.

Select UnionPay card (card number starting with 62) for receiving tax refund. You will receive tax refund within 5-10 days.

If tax-free goods are within the check-in luggage, please paste a tag on the luggage when going through the boarding procedure, take tax-free goods to the Customs Office for inspection, and get the tax refund voucher before having the goods checked. Pass the security check and go through follow-up formalities with the Tax-free Counter upon presentation of your tax refund voucher.

UnionPay Tax Refund Tips:

-

1. In Australia, no tax refund will be paid in cash. So, we

recommend you to use a UnionPay credit card to receive tax refund.

1. In Australia, no tax refund will be paid in cash. So, we

recommend you to use a UnionPay credit card to receive tax refund.

-

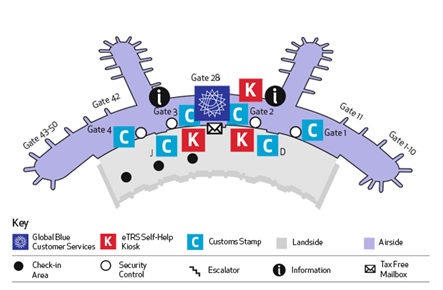

2. To make tax refund procedure easier for passengers,

Australia has introduced an official mobile TRS application (Multilingual with Chinese

inclusive). Upon completion of any purchase and acquisition of tax invoice, foreign

passenger should input personal information and tax invoice information, and select a

UnionPay credit card for receiving tax refund. App will generate a tax refund QR code

with which the passenger may quickly go through the tax refund procedure at the

Customs.

2. To make tax refund procedure easier for passengers,

Australia has introduced an official mobile TRS application (Multilingual with Chinese

inclusive). Upon completion of any purchase and acquisition of tax invoice, foreign

passenger should input personal information and tax invoice information, and select a

UnionPay credit card for receiving tax refund. App will generate a tax refund QR code

with which the passenger may quickly go through the tax refund procedure at the

Customs.

-

Location of Sydney Airport TRS point

-

Location of Melbourne Tullamarine Airport Customs

-

Japan

Japan

UnionPay Tax Refund Steps:

1. For any purchase over 5,000.00 Yen in stores posted with Tax-Free logo, please claim for tax refund (reference GST rate: 8%) from the store assistant by presenting your sales slip and passport.

2. Please present your UnionPay card at TRS counter and ask the store assistant to pay tax refund to your card; some stores may directly deduct tax refund when you pay the bill.

3. Conserve the Tax Refund Confirmation (which will generally be pasted to one of your passport pages) for inspection by the Customs.

UnionPay Tax Refund Tips:

-

1. Some small stores, such as drug stores, supermarkets and

convenience stores, may not be posted with the Tax-Free logo. Please show your passport

to the store assistant and inquire whether tax refund is available.

1. Some small stores, such as drug stores, supermarkets and

convenience stores, may not be posted with the Tax-Free logo. Please show your passport

to the store assistant and inquire whether tax refund is available.

-

2. Japanese airports will not handle tax refund issues.

Merchants will paste a tax refund particulars form on the passport, which will be ripped

and collected by the Japanese Customs on departure.

2. Japanese airports will not handle tax refund issues.

Merchants will paste a tax refund particulars form on the passport, which will be ripped

and collected by the Japanese Customs on departure.

Mainland China

Mainland China

UnionPay Tax Refund Steps:

Standard VAT rate:13% (general goods),9% (agricultural product, edible vegetable oil, books etc)

For goods which applied to VAT rate 13%, the refund amount is 11% of VAT invoice .For goods which applied to VAT rate 9%, the refund amount is 8% of VAT invoice. (processing fee will be deducted from refund amount, and rate varies in different cities, e.g. 2% of VAT invoice charged in Shanghai)

Foreign visitors holding valid passport, Hong Kong,China, Macau China and Taiwan China residents holding Mainland Travel Permit

The Traveler should stay in Mainland China for no more than 183 consecutive days (according to the date of entry to China in your passport); Purchase date does not exceed 90 days from the date of departure.

The minimum purchase amount for tax refund is RMB 500/TFS store/day/customer.

When leaving the country, foreign passengers should go through the formalities of

checking and confirming the items of tax refund to the customs. Overseas passengers

shall submit the following information when applying to the tax refund agency for

departure tax refund:

(1) his/her valid identity certificate;

(2) application form for tax refund for departure verified and signed by the

customs.

Then they may head for any one of the specific tax refund locations to receive their tax

refund.

UnionPay Tax Refund Tips:

-

Please arrive early at the airport (min.3 hours before

take-off)

Please arrive early at the airport (min.3 hours before

take-off)

-

At the Customs, please present your valid passport or ID along

with the VAT invoice(s), Tax Refund Application Form(s) and the Tax Free Goods.

At the Customs, please present your valid passport or ID along

with the VAT invoice(s), Tax Refund Application Form(s) and the Tax Free Goods.

-

Please get Customs Validation Stamp before immigration.

Please get Customs Validation Stamp before immigration.

-

Refund shall be proceed at the time of departure, overdue shall

be deemed as invalid.

Refund shall be proceed at the time of departure, overdue shall

be deemed as invalid.

Refund points for overseas tourists shopping Tax Free in Mainland China:

Shanghai Hongqiao International Airport/Shanghai Pudong International Airport Terminal 1/ Shanghai Pudong International Airport Terminal 2 (Departure) /Shanghai Downtown (for overseas tourists)

Refund points for tourists returning from abroad to Mainland China:

Beijing Capital International Airport Terminal 2 /Beijing Capital International Airport Terminal 3 /Shanghai Pudong International Airport Terminal 2 (Arrival) /Shanghai Downtown (for Chinese tourists) /Guangzhou Downtown/Guangzhou Airport /Beijing Downtown

Middle East region

United Arab Emirates

United Arab Emirates

UnionPay Tax Refund Steps:

1. The policy has not been implemented, which means that the UAE airport is not open counters for tourists to refund taxes. At present, the only way to refund the tax is to fill out the tax refund form and give the customs a knockout, and then go to the designated tax refund point.

UnionPay Tax Refund Tips:

-

The UAE VAT will be levied on January 1, 2018. The tax rate is

0%, 5%. Some industries' goods and services are exempt from VAT (most VAT is

5%).

The UAE VAT will be levied on January 1, 2018. The tax rate is

0%, 5%. Some industries' goods and services are exempt from VAT (most VAT is

5%).

The United Arab Emirates Domestic Court announced in early July 2018 that it would approve the VAT refund program for tourists. Visitors to the UAE can refund a refund of 5% VAT paid in the country.

The policy will be implemented in the fourth quarter of 2018 and will apply to all purchases at retailers participating in the tax refund policy. -

Visitor tax rebates must meet the following

requirements:

Visitor tax rebates must meet the following

requirements:

(1) Must be handed over in the UAE

(2). Must be purchased within three months of departure

(3). Must be carried out by the buyer personally within three months of purchase.

(4). Must be registered in the tax refund system to enjoy the tax refund

(5). The goods in question are not within the scope of tax exemption.

(6). Purchasing and exporting goods must be carried out in accordance with the provisions of the FTA -

There is a special electronic system, which only needs to

provide relevant information according to the requirements of the system, without manual

intervention.

There is a special electronic system, which only needs to

provide relevant information according to the requirements of the system, without manual

intervention.

Bahrain

Bahrain

UnionPay Tax Refund Steps:

The minimum purchase amount for tax refund is 100 BD per individual receipt. Purchasers

need to hold valid receipts or proof of purchase; otherwise, no refund will be given.

Purchase date does not exceed 60 days from the date of departure.

Your sales receipt with the VAT refund tag affixed to the back. Purchased goods (please

go to the validation desks before you check in your luggage, as you will have to show

the goods to our validation staff). At the same time ,please show us your passport and

travel ticket.

UnionPay Tax Refund Tips:

- Goods subject to VAT except for:

-

goods that have been consumed, fully or partly.

goods that have been consumed, fully or partly.

-

Motor vehicles, boats and aircrafts.

Motor vehicles, boats and aircrafts.

-

goods that are not accompanied by overseas tourist at the time

of leaving Bahrain.

goods that are not accompanied by overseas tourist at the time

of leaving Bahrain.

- You will receive 85% of the VAT paid, minus a fee of 0.50 BD per VAT Free tag validated.

Western Europe

Switzerland

Switzerland

UnionPay Tax Refund Procedure:

1. Tax refund is available for any purchase over 300.00 Swiss franc in Switzerland; when completing the Tax Refund Application, please select credit card for receiving tax refund, and complete a UnionPay card having card number starting with 62 and other necessary information (reference tax free rate: 8%).

2. Get the tax refund forms stamped by the airport Customs.

3. Find an airport tax refund counter or a mailbox to post the tax refund forms.

UnionPay Tax Refund Tips:

Switzerland is a Schengen State but not a member state of EU. Therefore, tax refund for purchases occurring in Switzerland must be claimed on departure from Switzerland. Tax refund for purchases made outside Switzerland must not be applied for in Switzerland.

-

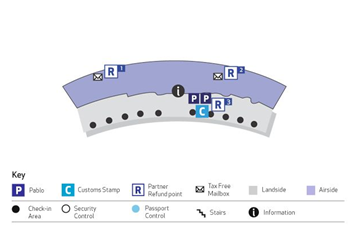

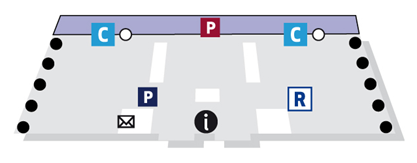

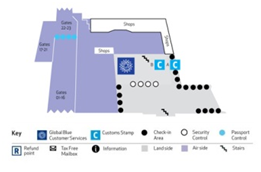

Geneva Contrin Airport

-

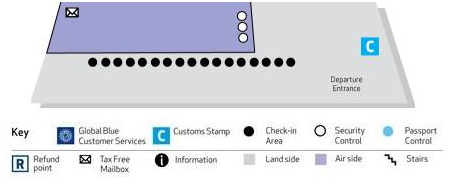

Zurich Airport Customs Office (the location marked "R")

- Behind the Security Control and can be accessed upon presentation of valid boarding pass.

Ireland

Ireland

UnionPay Tax Refund Procedure:

1. Tax refund is available for any purchase over 30.00 Euro; when completing the Tax Refund Application, please select credit card for receiving tax refund, and fill in a UnionPay card having card number starting with 62 and other essential information.

2. Stamped by the airport Customs (to enjoy the tax refund service at the Customs of Dublin Airport, you need to make a call to the airport).

3. Mail the Tax Refund Form and sales slips.

UnionPay Tax Refund Tips:

-

No tax refund is available for the following goods: children's

products, garment, food, and pharmaceuticals

No tax refund is available for the following goods: children's

products, garment, food, and pharmaceuticals

-

As Ireland is a member state of EU, tax refund for purchases

made in Ireland can be applied for in the last member state before departure from EU.

Accordingly, if you are heading for China from Ireland, tax refund for purchases made in

other member states can also be applied for in Ireland.

As Ireland is a member state of EU, tax refund for purchases

made in Ireland can be applied for in the last member state before departure from EU.

Accordingly, if you are heading for China from Ireland, tax refund for purchases made in

other member states can also be applied for in Ireland.

-

If your Tax Refund Form is issued by Global Blue, then:

If your Tax Refund Form is issued by Global Blue, then:

- a a) If the purchasing amount in the same Tax Refund Form is not more than 2,000.00 Euro, you can directly post the Tax Refund Form and original invoice without being stamped by the Customs when departing from Dublin/Shannon Airport;

-

b

b) If the purchase amount in the same Tax Refund Form is more

than 2,000.00 Euro, such Tax Refund Form must be stamped by the Customs before being

posted.

The above contents are only applicable to Tax Refund Forms issued in Ireland. Tax Refund Forms issued in other EU member states must be stamped by the Customs regardless of their value.

Ireland - Shannon Airport Tax Rebate Counter Location At the 10th position of the first floor

France

France

UnionPay Tax Refund Tips:

-

For any purchase over 100.01 Euro in stores posted with

Tax-Free logo, please claim a Tax Refund Form from the store assistant and select

UnionPay card (card number starting with 62) for receiving tax refund.

For any purchase over 100.01 Euro in stores posted with

Tax-Free logo, please claim a Tax Refund Form from the store assistant and select

UnionPay card (card number starting with 62) for receiving tax refund.

-

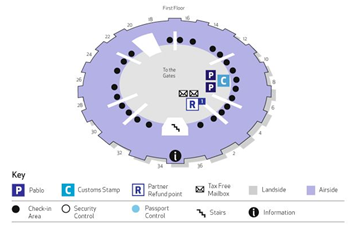

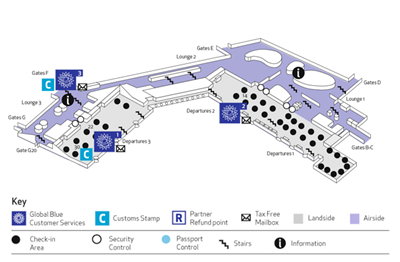

If you make purchases in Paris and get a Tax Refund Form

labeled with PABLO logo, you may get tax refund by using the convenient PABLO Self-help;

or else, you need to have your Tax Refund Form stamped artificially by the Customs.

PABLO Self-help 1 (blue) is installed opposite Counter 3 on Terminal 2E, which is easy

to be found (see picture below).

If you make purchases in Paris and get a Tax Refund Form

labeled with PABLO logo, you may get tax refund by using the convenient PABLO Self-help;

or else, you need to have your Tax Refund Form stamped artificially by the Customs.

PABLO Self-help 1 (blue) is installed opposite Counter 3 on Terminal 2E, which is easy

to be found (see picture below).

-

Post the scanned or stamped Tax Refund Form into the mailbox of

corresponding tax refund companies. In the case of tax refund in cash in France, extra

fees (about 3.00 Euro) will be charged for each Tax Refund Form. If you choose to

receive tax refund with UnionPay cards, no such fee will be charged.

Post the scanned or stamped Tax Refund Form into the mailbox of

corresponding tax refund companies. In the case of tax refund in cash in France, extra

fees (about 3.00 Euro) will be charged for each Tax Refund Form. If you choose to

receive tax refund with UnionPay cards, no such fee will be charged.

Information on Paris CDG Refund Points:

| T1: | CDG VAL Hall 6 |

| T2A: | Departure Gate 5 |

| T2C: | Departure Gate 4 |

| T2E: | Departure Gate 8 |

| T2F: | Arrival |

| Terminal 3: | Landside Departure |

-

(Tax Refund Form Scanner)

After scanning, find the mailbox beside PABLO Self-help and post the Tax Refund Form into the mailbox of corresponding tax-free company. If scanning fails, please contact the airport Customs for confirmation. -

Tax Refund Form for purchases made in EU member states other than France must be stamped by the Customs. After stamping, please post the Tax Refund Form into corresponding mailbox.

-

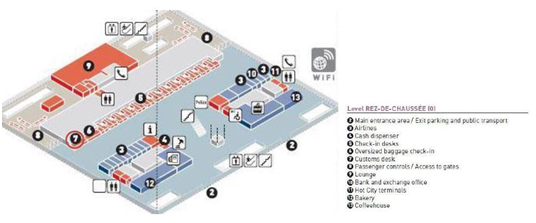

Paris CDG T1

-

Paris CDG T2A

-

Paris CDG T2C

-

Paris CDG T2E

-

Paris CDG T2F

-

Paris CDG T3

Germany

Germany

UnionPay Tax Refund Steps:

1. Apply for tax refund after purchase; when completing the Tax Refund Form, please choose credit card for receiving tax refund and fill in a UnionPay card having number starting with 62.

2. To get tax refund, you must firstly get the boarding pass by going through the boarding procedure (if tax-free goods are within the check-in luggage, please inform the airport staff in advance and take back the luggage after it is pasted with a tag), and then present your boarding pass, passport, Tax Refund Form, tax-free goods, and sales slip to the Customs for stamping of the Tax Refund Form.

3. Deliver the stamped Tax Refund Form to the counter of corresponding tax-free company or post it into the mailbox.

Frankfurt Planet Tax-free Counter (tax refund to UnionPay card is supported)

-

Frankrfurt Planet Tax Refund Counter (UnionPay App Real-time tax refund is supported)

-

Munich Terminal 1

-

Berlin Tegel Airport

Stamped by the Customs:

Customs Counter before Security Control: Counter 643 - German Customs is next to the Tax-free Counter

Customs Counter after Security Control: beside Boarding Gate B42

Tax-free Counter:

Daytime: Counter 643 - Tax-free Counter before Security Control is beside the Customs, Night time: changed to Section B Luggage Inquiry Counter during 21:30-6:30 Tax-free Counter after Security Control is beside the Customs at Boarding Gate B42. Tax Free Mailbox is generally beside the Tax-free Counter

-

Frankfurt Planet Tax-free Counter (tax refund to UnionPay card is supported)

Italy

Italy

Rome Fiumicino T3

1. For any purchase over 154.94 Euro in stores posted with Tax-Free logo, please claim Tax Refund only with passport information available at the store and select UnionPay card (card number starting with 62) for receiving tax refund. Please note that the card should be printed with Cardholder’s name.

2. To get tax refund at Roman airports, you must firstly get a boarding pass by going through the boarding procedure: If you have carry-on luggage only, you can directly pass the Security Control, and then go to the Customs Office to have your Tax Refund Form stamped;

If tax-free goods are included in check-in luggage, please inform the airport staff in advance and take back the luggage after it is pasted with a tag), and then carry your tax-free goods to the Customs for tax refund approval.

3. Apply for tax refund paid to UnionPay card at the Refund point after completion of stamping.The Refund point is located at Boarding Gate H1 after Security Control.

Post the Tax Refund Form and Tax Refund Envelope into the red mailbox opposite the tax refund inspection window

(Note: Tax Refund Forms issued in Italy shall be posted into the left mailbox labeled with ROMA logo while those issued in other countries into the right mailbox).

Information on Other Airports

-

Florence Airport

-

Milan Malpensa Airport

-

Malpensa Airport Tax-free Counter:

Spain

Spain

Madrid Airport UnionPay Tax Refund Steps:

1. Claim Tax Refund upon any purchase (with no minimum spend), and select UnionPay card (card number starting with 62) for receiving tax refund.

2. Tax refund can be applied for in Terminal T1 and T4 at Madrid Airport; please follow the sign (Aduana) in Spanish to find the Tax-free Counter.

Customs Stamp:

-

- T1 Customs Window is on the left of F1 Departure and

near Check-in Window 200;

- T1 Customs Window is on the left of F1 Departure and

near Check-in Window 200;

-

- T4 Customs Window is within F2 Departure Area and

beside Security Control;

- T4 Customs Window is within F2 Departure Area and

beside Security Control;

-

The business hours in both places are between

7:00-22:00. If you find no one working at the window during business hours,

please press the bell beside the window. The Customs staff will come out on

hearing the bell. - there is no need to get custom stamp for tax refund form

with DIVA logo. You can find the DIVA automatic tax refund machine at the

airport. Just follow the instructions on the machine and scan the tax return

barcode, passport, etc.

The business hours in both places are between

7:00-22:00. If you find no one working at the window during business hours,

please press the bell beside the window. The Customs staff will come out on

hearing the bell. - there is no need to get custom stamp for tax refund form

with DIVA logo. You can find the DIVA automatic tax refund machine at the

airport. Just follow the instructions on the machine and scan the tax return

barcode, passport, etc.

3. Deliver the stamped Tax Refund Form to the Tax-free Counter or directly or post it into the mailbox.

-

- The Tax Refund Envelope issued by Global Blue is

prepaid and can be posted to any of the yellow mailboxes at the airport.

- The Tax Refund Envelope issued by Global Blue is

prepaid and can be posted to any of the yellow mailboxes at the airport.

-

- After T1 Security Control, you will see a Global

Blue Counter labeled with a blue sign where you may submit the Tax Refund Form

directly to the counter clerk.

- After T1 Security Control, you will see a Global

Blue Counter labeled with a blue sign where you may submit the Tax Refund Form

directly to the counter clerk.

- * *In the case of tax refund in cash, extra fees (3.00 Euro) will be charged for each Global Tax Refund Form (no handling charge will be charged for Tax Refund Forms issued in Spain). If you choose to receive tax refund with UnionPay cards, no such fee will be charged.

Barcelona Terminal 1 Floor 1

Madrid Barajas Terminal 1

Madrid Barajas

Terminal 4S

Global Blue Refund point is near Boarding Gate S26-S28

Portugal

Portugal

UnionPay Tax Refund Steps:

1. For any purchase over 50.00-60.00 Euro in the same tax-free store on the same day, tourists from non-EU member states may claim a Tax Refund Form from the store assistant and select UnionPay card (card number starting with 62) for receiving tax refund.

2. Go through the boarding procedure, present your Tax Refund Application Form, passport, visa and purchased goods to the Customs for stamping of the Tax Refund Application Form (The Customs Stamp of Brisbane Airport is located at Check-in Counter 101), and then have your luggage checked.

3. Post the stamped Tax Refund Form into the Tax Free Mailbox.

UnionPay Tax Refund Tips:

Please note that in Portugal, the minimum amount of purchase for tax refund varies with the VAT type.

-

EUR 52.87(6%)

EUR 52.87(6%)

-

EUR 56.36(13%)

EUR 56.36(13%)

-

EUR 61.35(23%)

EUR 61.35(23%)

-

EUR 57.87(16%)

EUR 57.87(16%)

-

EUR 60.85(22%)

EUR 60.85(22%)

Locations of the Customs and Global Blue Tax-free Counter at Lisbon Airport

UnionPay App Real-time Tax Refund is supported at Planet Tax Refund Counter

Netherlands

Netherlands

UnionPay Tax Refund Steps:

1. For any purchase over 50.00 Euro in the same tax-free store on the same day, tourists from non-EU member states may claim a GST Refund Form from the store assistant and select UnionPay card (card number starting with 62) for receiving tax refund.

2. Before going through the boarding procedure, please present your Tax Refund Application Form, passport, visa and purchased goods to the Customs for stamping of the Tax Refund Application Form;

-

Please note that if the amount of purchase is more than

2,000.00 Euro (inclusive), please have the Tax Refund Application Form stamped

at the Customs Office opposite Departure Hall 2 Boarding Gate D10;

Please note that if the amount of purchase is more than

2,000.00 Euro (inclusive), please have the Tax Refund Application Form stamped

at the Customs Office opposite Departure Hall 2 Boarding Gate D10;

-

If the amount of purchase is less than 2,000.00 Euro,

please have the Tax Refund Application Form stamped at the Customs Office

between departure Lounge 2 and 3;

If the amount of purchase is less than 2,000.00 Euro,

please have the Tax Refund Application Form stamped at the Customs Office

between departure Lounge 2 and 3;

3. Post the stamped Tax Refund Form into the Tax Free Mailbox. The nearest Tax-free Counter is next to the Customs Counter.

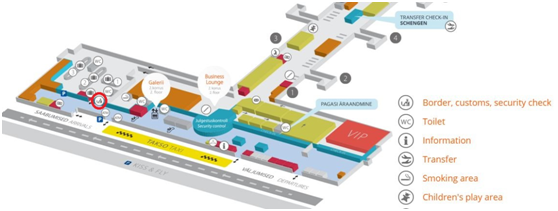

阿姆斯特丹史基浦机场 Amsterdam Schipol,AMS

Belgium

Belgium

UnionPay Tax Refund Steps:

1. Tax refund can be applied for any purchase over 50.00 Euro in the same tax-free store on the same day; when completing the Tax Refund Form, please choose credit card for receiving tax refund and fill in a UnionPay card having number starting with 62. (Reference tax free rate: 21% for general goods; 6% for food; handling charge will be deducted by the tax-free company)

2. When departing from Island, please present your passport, Tax Refund Form, tax-free goods and sales slip to the Customs Office (Brussels International Airport Customs Office is near International Departure Gate B) for examination and tax refunding before going through the boarding procedure.

3. Post the stamped Tax Refund Form together with the sales slip to the mailbox.

UnionPay Tax Refund Tips:

-

No tax refund is available for tobacco purchased in

Belgium

No tax refund is available for tobacco purchased in

Belgium

-

As Belgium is a member state of EU, tax refund for purchases

made in Belgium can be applied for in the last member state before departure from EU.

Accordingly, if you are heading for China from Belgium, tax refund for purchases made in

other member states can also be applied for in Belgium.

As Belgium is a member state of EU, tax refund for purchases

made in Belgium can be applied for in the last member state before departure from EU.

Accordingly, if you are heading for China from Belgium, tax refund for purchases made in

other member states can also be applied for in Belgium.

Locations of the Customs and Refund point at Brussels International Airport:

Luxembourg

Luxembourg

UnionPay Tax Refund Steps:

1. Tax refund can be applied for any purchase over 74.00 Euro; when completing the Tax Refund Form, please choose credit card for receiving tax refund and fill in a UnionPay card having number starting with 62. (Reference tax free rate: VAT 15%)

2. When departing from Island, please present your passport, Tax Refund Form, tax-free goods and sales slip to the Customs Office (near Luxembourg-Findel International Airport International Arrival Gate B) for examination and tax refunding before going through the boarding procedure.

3. Post the stamped Tax Refund Form together with the sales slip to the mailbox.

UnionPay Tax Refund Tips:

-

Luxembourg is a member of the European Union. Consumption in

Luxembourg can also be refunded in the last member state before leaving the EU.

Similarly, if you return from Luxembourg, the consumption in other EU countries can also

be refunded.

Luxembourg is a member of the European Union. Consumption in

Luxembourg can also be refunded in the last member state before leaving the EU.

Similarly, if you return from Luxembourg, the consumption in other EU countries can also

be refunded.

Locations of the Customs at Luxembourg-Findel International Airport

Eastern Europe

Czech Republic

Czech Republic

UnionPay Tax Refund Steps:

1. Tax refund can be applied for any purchase over 2,001.00 Czech Koruna (about RMB551.00); when completing the Tax Refund Form, please choose credit card for receiving tax refund and fill in a UnionPay card having number starting with 62 (reference tax free rate: 21% for general goods: 15% for books, medicines, and spectacles; the tax refund received will deduct the handling charge charged by the tax-free company).

2. If tax-free goods are within the check-in luggage, then

before going through the boarding procedure, please apply to the Customs Office for tax

refund by presenting your Tax Refund Form, passport, tax-free goods and sales slip to

the Customs Office for inspection and stamping.

If tax-free goods are within the carry-on luggage, please go through the tax refund

procedure with the Customs Office at the Departure Hall after Security Control.

3. Post the stamped Tax Refund Form to the counter or mailbox of corresponding tax-free company.

UnionPay Tax Refund Tips:

-

No tax refund is available for the following goods: food,

spirit and automobiles

No tax refund is available for the following goods: food,

spirit and automobiles

-

As Czech Republic is a member state of EU, tax refund for

purchases made in Czech Republic can be applied for in the last member state before

departure from EU. Accordingly, if you are heading for China from Czech Republic, tax

refund for purchases made in other member states can also be applied for in Czech

Republic.

As Czech Republic is a member state of EU, tax refund for

purchases made in Czech Republic can be applied for in the last member state before

departure from EU. Accordingly, if you are heading for China from Czech Republic, tax

refund for purchases made in other member states can also be applied for in Czech

Republic.

-

In the case of tax refund in cash, handling charge of 80.00

krone (about RMB22.00) will be charged for each Tax Refund Form. If you choose to

receive tax refund with UnionPay cards, no such fee will be charged.

In the case of tax refund in cash, handling charge of 80.00

krone (about RMB22.00) will be charged for each Tax Refund Form. If you choose to

receive tax refund with UnionPay cards, no such fee will be charged.

Locations of Customs Office and Tax-free Counter:

Václav Havel Airport Prague

-

Terminal 1 North 1

-

Terminal 2 North 1

-

Terminal North 2

Austria

Austria

UnionPay Tax Refund Steps:

1. Tax refund can be applied for any purchase over 75.01 Euro; when completing the Tax Refund Form, please choose credit card for receiving tax refund and fill in a UnionPay card having number starting with 62.

2. If tax-free goods are within the check-in luggage, then before going through the boarding procedure, please apply to the Customs Office for tax refund by presenting your Tax Refund Form, passport, tax-free goods and sales slip to the Customs Office for inspection and stamping.

If tax-free goods are within the carry-on luggage, please go through the tax refund procedure with the Customs Office at the Departure Hall after Security Control.

3. Post the stamped Tax Refund Form to the counter or mailbox of corresponding tax-free company.

UnionPay Tax Refund Tips:

-

As Austria is a member state of EU, tax refund for purchases

made in Austria can be applied for in the last member state before departure from EU.

Accordingly, if you are heading for China from Austria, tax refund for purchases made in

other member states can also be applied for in Austria.

As Austria is a member state of EU, tax refund for purchases

made in Austria can be applied for in the last member state before departure from EU.

Accordingly, if you are heading for China from Austria, tax refund for purchases made in

other member states can also be applied for in Austria.

-

In the case of tax refund in cash, 3.00 Euro handling charge

will be charged for each Tax Refund Form. If you choose to receive tax refund with

UnionPay cards, no such fee will be charged.

In the case of tax refund in cash, 3.00 Euro handling charge

will be charged for each Tax Refund Form. If you choose to receive tax refund with

UnionPay cards, no such fee will be charged.

-

Locations of the Customs and Tax-free Counter/Mailbox at Vienna International Airport:

Hungray

Hungray

UnionPay Tax Refund Steps:

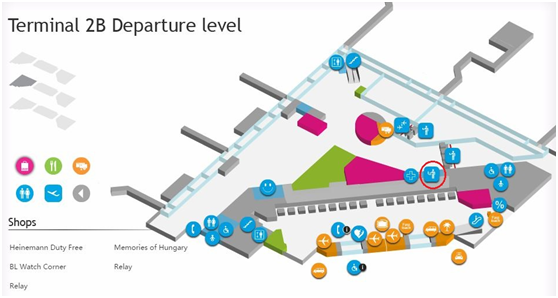

1. Tax refund can be applied for any purchase over 55,000.01 Hungarian forint (about RMB1,334.50); when completing the Tax Refund Form, please choose credit card for receiving tax refund and fill in a UnionPay card having number starting with 62.

2. Note: Budapest Liszt Ferenc International Airport has only one International Departure Customs Check Point which is located outside the Security Control in Terminal 2B; if your Check-in Counter is located in Terminal 2A, tax refund shall also be applied for at this Check Point.

3. Mail the Tax Refund Form.

UnionPay Tax Refund Tips:

-

As Hungary is a member state of EU, tax refund for purchases

made in Hungary can be applied for in the last member state before departure from EU.

Accordingly, if you are heading for China from Hungary, tax refund for purchases made in

other member states can also be applied for in Hungary.

As Hungary is a member state of EU, tax refund for purchases

made in Hungary can be applied for in the last member state before departure from EU.

Accordingly, if you are heading for China from Hungary, tax refund for purchases made in

other member states can also be applied for in Hungary.

-

Location of the Customs at Budapest Ferihegy International Airport:

Slovakia

Slovakia

UnionPay Tax Refund Steps:

1. Tax refund can be applied for any purchase over 175.01 Euro in the designated tax-free store; when completing the Tax Refund Form, please choose credit card for receiving tax refund and fill in a UnionPay card having number starting with 62 (reference tax free rate: VAT 20%).

2. If tax-free goods are within the check-in luggage, then

before going through the boarding procedure, please apply to the Customs Office for tax

refund by presenting your Tax Refund Form, passport, tax-free goods and sales slip to

the Customs Office for inspection and stamping.

If tax-free goods are within the

carry-on luggage, please go through the tax refund procedure with the Customs Office at

the Departure Hall after Security Control.

3. Post the stamped Tax Refund Form to the counter or mailbox of corresponding tax-free company.

Slovakia Bratislava Airport IVANKA Customs Check Point

UnionPay Tax Refund Tips:

-

As Slovakia is a member state of EU, tax refund for purchases

made in Slovakia can be applied for in the last member state before departure from EU.

Accordingly, if you are heading for China from Slovakia, tax refund for purchases made

in other member states within three (3) months can also be applied for in

Slovakia.

As Slovakia is a member state of EU, tax refund for purchases

made in Slovakia can be applied for in the last member state before departure from EU.

Accordingly, if you are heading for China from Slovakia, tax refund for purchases made

in other member states within three (3) months can also be applied for in

Slovakia.

-

In the case of tax refund in cash, 3.00 Euro handling charge

will be charged for each Tax Refund Form. If you choose to receive tax refund with

UnionPay cards, no such fee will be charged.

In the case of tax refund in cash, 3.00 Euro handling charge

will be charged for each Tax Refund Form. If you choose to receive tax refund with

UnionPay cards, no such fee will be charged.

Slovenia

Slovenia

UnionPay Tax Refund Steps:

1. Tax refund can be applied for any purchase over 50.01 Euro in a single receipt; when completing the Tax Refund Form, please choose credit card for receiving tax refund and fill in a UnionPay card having number starting with 62.

2. If tax-free goods are within the check-in luggage, then before going through the boarding procedure, please apply to the Customs Office for tax refund by presenting your Tax Refund Form, passport, tax-free goods and sales slip to the Customs Office for inspection and stamping.

If tax-free goods are within the carry-on luggage, please go through the tax refund procedure with the Customs Office at the Departure Hall after Security Control.

3. Post the stamped Tax Refund Form to the counter or mailbox of corresponding tax-free company.

UnionPay Tax Refund Tips:

Location of Ljubljana Airport Customs:

(As shown in the picture, there are two Customs Offices, each being located in and outside the Security Control)

Slovak Fak's non-refundable items: fuel, mineral oil, alcohol and alcohol, tobacco

Croatia

Croatia

UnionPay Tax Refund Steps:

1. Tax refund can be applied for any purchase over 740 Kuna (about RMB680.00) in a single receipt; when completing the Tax Refund Form, please choose credit card for receiving tax refund and fill in a UnionPay card having number starting with 62.

2. If tax-free goods are within the check-in luggage, then before going through the boarding procedure, please apply to the Customs Office for tax refund by presenting your Tax Refund Form, passport, tax-free goods and sales slip to the Customs Office for inspection and stamping.

If tax-free goods are within the carry-on luggage, please go through the tax refund procedure with the Customs Office at the Departure Hall after Security Control.

3. Post the stamped Tax Refund Form to the counter or mailbox of corresponding tax-free company.

UnionPay Tax Refund Tips:

As Croatia is a member state of EU, tax refund for purchases made in Croatia can be applied for in the last member state before departure from EU. Accordingly, if you are heading for China from Croatia, tax refund for purchases made in other member states within three (3) months can also be applied for in Croatia.

Location of Zagreb International Airport Customs:

Russia

Russia

UnionPay Tax Refund Steps:

1. Claim tax refund upon spending more than 10,000 Russian rubles (about 1178 yuan) in the same designated merchant in one day. Please select the UnionPay card with the card number starting with 62 as the tax refund payment option. (The tax refund rate is about 11%)

2. Before departure get tax refund forms stamped by the customs.

3. - If you are going to claim by yourself, you can put the

receipts and forms into a specified mailbox near the tax refund points. After one or two

weeks, the tax refund amount will be paid to the UnionPay card. This method allows

consumers to get a full refund.

- Consumers can also choose to refund the tax

through the tax-free system. Submit the form and receipt to the tax refund counters for

review. (The tax-free system is operated by Russian domestic operators and two foreign

companies Global Blue and Planet, so consumers need to find the signs of the two

companies at the VAT tax refund point) but this method will generate 5%~ 15% handling

fee.

UnionPay Tax Refund Tips:

Goods that cannot be tax refunded, such as alcohol, cigarettes, automobiles, motorcycles, gasoline and diesel fuel.

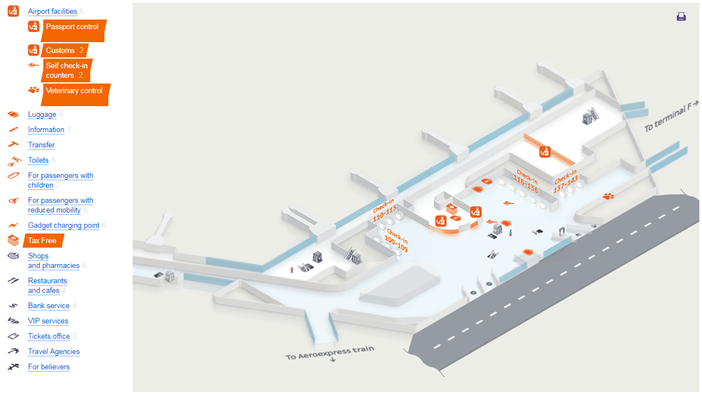

-

Terminal D

-

Terminal E

-

Terminal F

Location of the Customs at Sheremetyevo International Airport

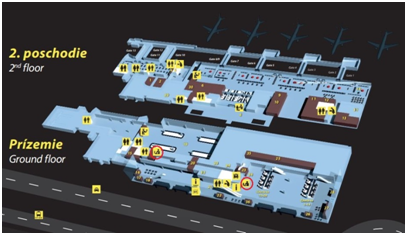

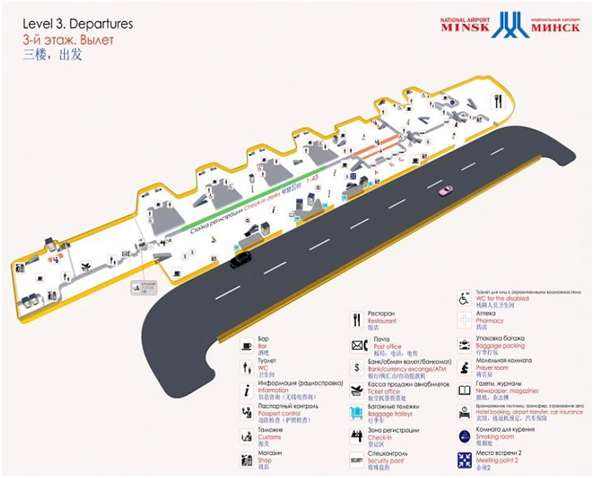

Belarus

Belarus

UnionPay Tax Refund Steps:

Claim tax refund upon spending more than 93 Belarusian rubles (about 320 RMB). Please choose the UnionPay card with the card number starting with 62 as the tax refund payment option.

Before departure, the tax refund form must be stamped by the customs. The tax refund goods must be displayed to the customs to ensure that the goods will be taken out of Belarus. Please check in to collect your boarding pass before going for the custom approval. Be sure to take out the baggage from the tax refunded goods or inform the customs to avoid unnecessary trouble. Then bring the tax refund form, shopping voucher and boarding documents to the customs counter to obtain the customs seal.

UnionPay Tax Refund Tips:

The VAT will be returned at the border checkpoint to the purchaser of the goods with the valid receipts. If there is no bank office at the checkpoint, the tax refund amount will be returned to the buyer account.

Macedonia

Macedonia

UnionPay Tax Refund Steps:

In Macedonia, in most countries, Macedonia Airport does not provide tax refund services. Visitors are required to go to the designated tax refund point of CortEx to enjoy the full VAT refund service. Please select the UnionPay card with the card number starting with 62 as the tax refund payment option.

Non-local visitors are required to bring valid documents and designated store payment credentials. After approval by the tax refund agency, the VAT received will be refunded in full.

UnionPay Tax Refund Tips:

-

Any goods in the store designated to participate in the tax

refund will be given a tax refund right. Most of the goods will be fully refunded VAT,

and there is no minimum consumption requirement.

Any goods in the store designated to participate in the tax

refund will be given a tax refund right. Most of the goods will be fully refunded VAT,

and there is no minimum consumption requirement.

CortEx opening hours are as follows:

Monday to Friday: from 08:30

to 20:30

Saturday : from 09:00 to 16:00

Sunday: Rest.

Location of the offices at Skopje International Airport

Moldova

Moldova

UnionPay Tax Refund Steps:

After shopping at stores with tax refund labels for over 300 MDL (around 360 RMB), foreign tourists can enjoy value-added tax refund. Any goods purchased from labelled shops will grant consumers rights to be tax refunded. When filling out the tax refund form, please select the credit card tax refund and fill in the UnionPay card number with the card number starting with 62.( Most of the value-added tax charged in Moldova is 20%, 8% or 0% reduced tax may exists in some transactions.)

Get the custom stamp before departure

Submit the valid tax refund from to the tax refund counters.

UnionPay Tax Refund Tips:

-

Moldova has a fixed promotion month every year in January and

July. During the promotion season, every large shopping mall (For example, Field’’s

Fisktorvet, Magasin, Illum, etc.) will offer discounted products. Foreign visitors can

take advantage of this feature to save on their shopping streaks.

Moldova has a fixed promotion month every year in January and

July. During the promotion season, every large shopping mall (For example, Field’’s

Fisktorvet, Magasin, Illum, etc.) will offer discounted products. Foreign visitors can

take advantage of this feature to save on their shopping streaks.

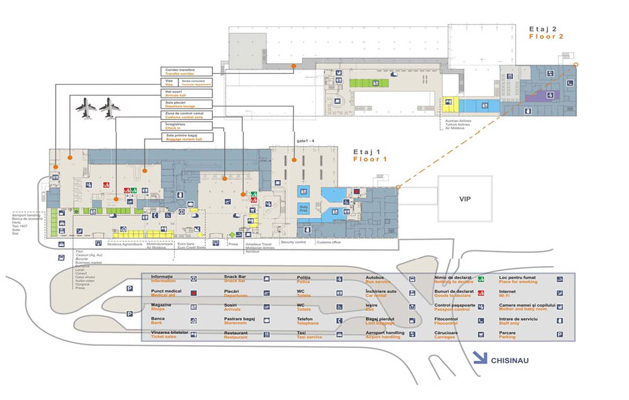

Chisinau International Airport customs and tax refund points

Tax refund points open hours:

Mon-Fri 9:00 am- 4:30pm

Sat 9:00

am- 2:30pm

Sun closed

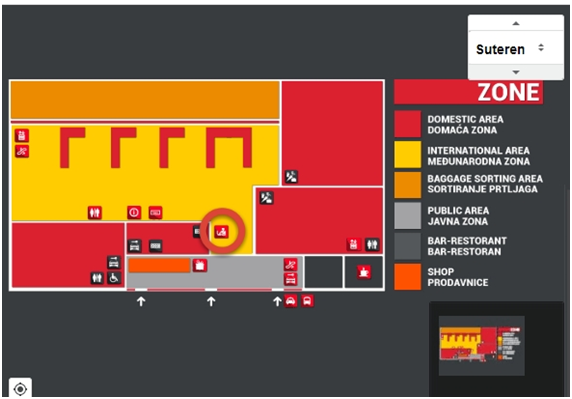

Serbia

Serbia

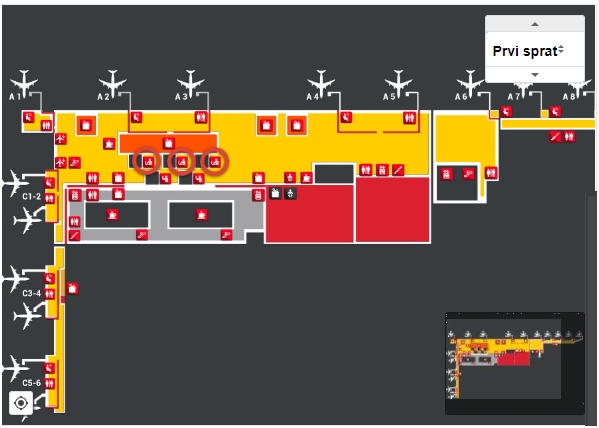

UnionPay Tax Refund Steps:

Buying goods at the same store for 200 euros (about 1515.86 yuan) request a refund form from the retailer with valid invoices. Please select the UnionPay card with the card number starting with 62 as the tax refund payment option. (VAT is 20%, most products will be refunded up to 20% VAT)

get the forms stamped by the Customs before departure.

Go to the specified tax refund counter at airports or to the tax refund companies, such as Global Blue, to receive the VAT refund.

UnionPay Tax Refund Tips:

-

Serbia can not take cash rebate at the airport, still need to

go to the original shopping business, so it is recommended to use the UnionPay card with

the card number starting with 62 as the tax refund payment option, eliminating the need

to go to the business again.

Serbia can not take cash rebate at the airport, still need to

go to the original shopping business, so it is recommended to use the UnionPay card with

the card number starting with 62 as the tax refund payment option, eliminating the need

to go to the business again.

-

Customer could receive the tax refund amount in cash at the

stores with stamped tax free forms, otherwise, customer could mail back the forms to the

stores, and the merchants will refund the amount to the bank account.

Customer could receive the tax refund amount in cash at the

stores with stamped tax free forms, otherwise, customer could mail back the forms to the

stores, and the merchants will refund the amount to the bank account.

Location of the customs at Belgrade Nikola Tesla Airport

Ukraine

Ukraine

UnionPay Tax Refund Steps:

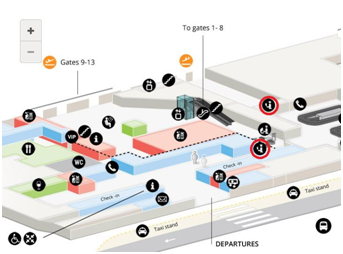

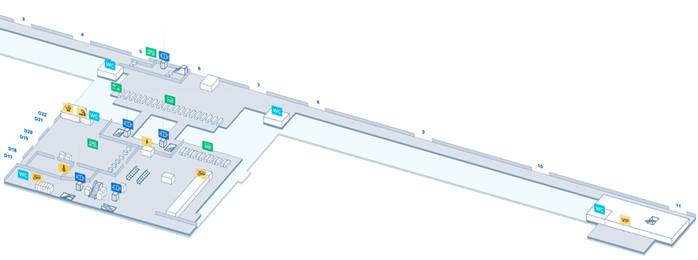

Foreign individuals cannot be registered as VAT payers. Therefore, the VAT generated in shopping in Ukraine cannot be returned. The only individual that can be refunded is a foreign enterprise registered as VAT payer in Ukraine

Boryspil International Airport

-

Terminal D 2 level

-

Terminal D 3 level

Northern Europe

Denmark

Denmark

UnionPay Tax Refund Steps:

1. Tax refund can be applied for any purchase over 300 Danish krone (about RMB 302.00) in a single receipt; when completing the Tax Refund Form, please choose credit card for receiving tax refund and fill in a UnionPay card having number starting with 62. In Denmark, the VAT rate is 25% and the actual tax refund form is between 12-25%.

2. Go through the boarding procedure and then present your boarding pass, passport, Tax Refund Form, tax-free goods and sales slip to Terminal 3 Customs Service Counter for stamping. If tax-free goods are within the check-in luggage, please inform the airport staff in advance and complete the tax refund procedure before having the luggage checked.

1. Post the stamped Tax Refund Form to the counter or mailbox of corresponding tax-free company.

UnionPay Tax Refund Tips:

-

As Denmark is a member state of EU, tax refund for purchases

made in Denmark can be applied for in the last member state before departure from EU.

Accordingly, if you are heading for China from Denmark, tax refund for purchases made in

other member states within three (3) months can also be applied for in Denmark.

As Denmark is a member state of EU, tax refund for purchases

made in Denmark can be applied for in the last member state before departure from EU.

Accordingly, if you are heading for China from Denmark, tax refund for purchases made in

other member states within three (3) months can also be applied for in Denmark.

-

Tax Refund Forms for purchases made in Denmark, Sweden, Finland

and Norway may be stamped at the Tax Refund Agency Counter between Terminal 2 and 3

without the need to be stamped by the Customs; Tax Refund Forms issued in EU member

states other than these four (4) states must also be stamped at the Customs

Counter.

Tax Refund Forms for purchases made in Denmark, Sweden, Finland

and Norway may be stamped at the Tax Refund Agency Counter between Terminal 2 and 3

without the need to be stamped by the Customs; Tax Refund Forms issued in EU member

states other than these four (4) states must also be stamped at the Customs

Counter.

Copenhagen International Airport

Sweden

Sweden

UnionPay Tax Refund Steps:

1. Tax refund can be applied for any purchase over 200.00 Swedish krona (about RMB156.38) in a single receipt; when completing the Tax Refund Form, please choose credit card for receiving tax refund and fill in a UnionPay card having number starting with 62. (Reference tax free rate: 25% for general goods, 12% for food and 6% for books)

2. Go through the boarding procedure and then present your boarding pass, passport, Tax Refund Form, tax-free goods and sales slip to corresponding tax-free company for examination and tax refunding. If tax-free goods are within the check-in luggage, please inform the airport staff in advance and complete the tax refund procedure before having the luggage checked.

Note: Blue Tax Free Forms for purchases made in Denmark, Sweden, Finland and Norway may be stamped at the Global Blue Tax Refund Agency Counter in Terminal 5 without the need to be stamped by the Customs; Tax Refund Forms issued in EU member states other than these four (4) states must also be stamped at the Customs Counter on Terminal 5 Departure level.

3. Post the stamped Tax Refund Form to the counter or mailbox of corresponding tax-free company.

UnionPay Tax Refund Tips:

-

As Sweden is a member state of EU, tax refund for purchases

made in Sweden can be applied for in the last member state before departure from EU.

Accordingly, if you are heading for China from Sweden, tax refund for purchases made in

other member states within three (3) months can also be applied for in Sweden.

As Sweden is a member state of EU, tax refund for purchases

made in Sweden can be applied for in the last member state before departure from EU.

Accordingly, if you are heading for China from Sweden, tax refund for purchases made in

other member states within three (3) months can also be applied for in Sweden.

-

Goods with a VAT rate of 6% are not refundable, ie books cannot

be refunded.

Goods with a VAT rate of 6% are not refundable, ie books cannot

be refunded.

Locations of the Customs and Tax-free Counter at Stockholm Arlanda International Airport

Finland

Finland

UnionPay Tax Refund Steps:

1. Tax refund can be applied for any purchase over 40 Euro in a single receipt; when completing the Tax Refund Form, please choose credit card for receiving tax refund and fill in a UnionPay card having number starting with 62. (Reference tax free rate: 24% for general goods, 14% for food; actual tax free rate: 12-16%)

2. When departing from Finland, firstly go through the boarding procedure and then present your boarding pass, passport, Tax Refund Form, tax-free goods and sales slip to corresponding tax-free company or the Customs Office for examination and tax refunding. If tax-free goods are within the check-in luggage, please inform the airport staff in advance and complete the tax refund procedure before having the luggage checked.

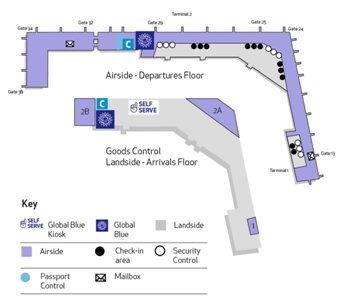

Note: Global Blue Tax Free Forms for purchases made in Denmark, Sweden, Finland and Norway may be stamped at the Global Blue Tax Refund Agency Counter near Gate 29 in Helsinki Airport Terminal 2 without the need to be stamped by the Customs; Tax Refund Forms issued in EU member states other than these four (4) states must also be stamped at the Customs Counter.

3. Post the stamped Tax Refund Form together with the sales slip to the counter or mailbox of corresponding tax-free company.

UnionPay Tax Refund Tips:

As Finland is a member state of EU, tax refund for purchases made in Finland can be applied for in the last member state before departure from EU. Accordingly, if you are heading for China from Finland, tax refund for purchases made in other member states within three (3) months can also be applied for in Finland.

Locations of the Customs and Tax Free Counter at Helsinki Airport

Norway

Norway

UnionPay Tax Refund Steps:

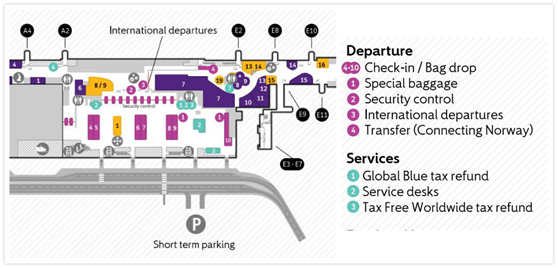

1. Tax refund can be applied for any purchase over 315.00 Norwegian Krone (about RMB 259.00) or over 290.00 Norwegian Krone (about RMB 238.00) in a single receipt; when completing the Tax Refund Form, please choose credit card for receiving tax refund and fill in a UnionPay card having number starting with 62. (Reference tax free rate: 25% for general goods, 15% for food; actual tax free rate: 12-16%)

2. When departing from Finland, please present your boarding pass, passport, Tax Refund Form, tax-free goods and sales slip to corresponding tax-free company or the Customs Office for examination and tax refunding before going through the boarding procedure (at Oslo Airport, no tax refund can be applied for after passing the Security Control).

Note: Global Blue Tax Free Forms for purchases made in Denmark, Sweden, Finland and Norway may be stamped at the Global Blue Tax Refund Agency Counter near the boarding security gate at Oslo Airport without the need to be stamped by the Customs; Tax Refund Forms issued in EU member states other than these four (4) states must also be stamped at the Customs Counter.

3. Post the stamped Tax Refund Form together with the sales slip to the counter or mailbox of corresponding tax-free company.

UnionPay Tax Refund Tips:

-

As Norway is not an EU member state, you must go through the

tax refund procedure before departing from Norway if you are heading for other European

regions.

As Norway is not an EU member state, you must go through the

tax refund procedure before departing from Norway if you are heading for other European

regions.

-

Please note that you must go through the tax refund procedure

within one (1) month after purchase in Norway.

Please note that you must go through the tax refund procedure

within one (1) month after purchase in Norway.

-

Norway does not need to look at the passport and can unpack it

when shopping. However, Norway uses a credit card to make a purchase. If the credit card

does not have a chip (usually the domestic card is a magnetic stripe), you need to check

the passport to check the credit card holder and signature.

Norway does not need to look at the passport and can unpack it

when shopping. However, Norway uses a credit card to make a purchase. If the credit card

does not have a chip (usually the domestic card is a magnetic stripe), you need to check

the passport to check the credit card holder and signature.

Locations of the Customs and Tax Free Counter at Oslo Airport

Faroe Islands

Faroe Islands

UnionPay Tax Refund Steps:

Tax refund service is available to Non-Faroese residents. The minimum purchase amount for tax refund is 100 Euro per individual receipt.

Purchase date does not exceed 90 days from the date of departure. Theoretically, a tax refund form stamped with a valid customs seal is valid for a year from the date of issuance of the tax refund form.

When leaving the last country in the Eu, please show the sealed and unused goods, tax refund form and shopping receipt to the customs, and ask the customs officer to stamp the tax refund form in the corresponding place.

A tax refund form without customs seal shall be deemed to be invalid. After returning to China, you can apply for tax refund with the tax refund form with customs seal, the original shopping receipt and your personal passport.

Faroe Islands

Faroe Islands

UnionPay Tax Refund Steps:

Tax refund service is available to Non-Faroese residents. The minimum purchase amount for tax refund is 100 Euro per individual receipt.

Purchase date does not exceed 90 days from the date of departure. Theoretically, a tax refund form stamped with a valid customs seal is valid for a year from the date of issuance of the tax refund form.

When leaving the last country in the Eu, please show the sealed and unused goods, tax refund form and shopping receipt to the customs, and ask the customs officer to stamp the tax refund form in the corresponding place.

A tax refund form without customs seal shall be deemed to be invalid. After returning to China, you can apply for tax refund with the tax refund form with customs seal, the original shopping receipt and your personal passport.

Mediterranean Region

Greece

Greece

UnionPay Tax Refund Steps:

1. Tax refund can be applied for any purchase over 120.00 Euro in the same tax-free store; when completing the Tax Refund Form, please choose credit card for receiving tax refund and fill in a UnionPay card having number starting with 62.

2. Before going through the boarding procedure, please apply to the Customs Office for tax refund by presenting your Tax Refund Form, passport, tax-free goods and sales slip to the Customs Office for inspection and stamping;

3. Mail the stamped Tax Refund Form; or after Security Control, submit the Tax Refund Form to corresponding Tax-free Counter or post it into corresponding mailbox.

UnionPay Tax Refund Tips:

-

No tax refund is available for wines and food purchased in

Greece.

No tax refund is available for wines and food purchased in

Greece.

-

The validity term of Tax Refund Form stamped by the Customs

shall be within ninety (90) days since the date of purchase. You must have your Tax

Refund Form stamped by the Greek Customs or the Customs of other EU member state within

three (3) months from the month of purchase.

The validity term of Tax Refund Form stamped by the Customs

shall be within ninety (90) days since the date of purchase. You must have your Tax

Refund Form stamped by the Greek Customs or the Customs of other EU member state within

three (3) months from the month of purchase.

-

In addition to the stamp of Greek Customs, the Tax Refund Form

must also bear the name of Customs officer.

In addition to the stamp of Greek Customs, the Tax Refund Form

must also bear the name of Customs officer.

-

The tax free rate is 24% for Greek Island and Aegean Island and

17% for other small islands.

The tax free rate is 24% for Greek Island and Aegean Island and

17% for other small islands.

-

when the customs seal, pay attention to each joint must be

covered, do not leak 。

when the customs seal, pay attention to each joint must be

covered, do not leak 。

Location of Greece Athens Airport Customs

Athens International Airport

(UnionPay APP Real-time Tax Refund is supported at Planet Tax Refund Counter)

Morocco

Morocco

UnionPay Tax Refund Steps:

1. Tax refund can be applied for any purchase over 2,000.00 Morocco Dirham (about RMB 1,372.00); when completing the Tax Refund Form, please choose credit card for receiving tax refund and fill in a UnionPay card having number starting with 62.

2. Before going through the boarding procedure, please apply to the Customs Office for tax refund by presenting your Tax Refund Form, passport, tax-free goods and sales slip to the Customs Office for inspection and stamping. In Morocco, tax refund can be applied for at Casablanca Airport and Marrakech Airport.

3. Post the stamped Tax Refund Form to the counter or mailbox of corresponding tax-free company. You will receive the tax refund within 10 days.

UnionPay Tax Refund Tips:

-

No tax refund is available for the following goods: food (solid

and liquid), tobacco, medicines, gem, transportation for private uses, proprietary

cultural relics.

No tax refund is available for the following goods: food (solid

and liquid), tobacco, medicines, gem, transportation for private uses, proprietary

cultural relics.

-

Cash rebate: limited to 5,000 Moroccan dirhams (or equivalent

euro/dollar) using UnionPay card without this restriction

Cash rebate: limited to 5,000 Moroccan dirhams (or equivalent

euro/dollar) using UnionPay card without this restriction

-

tax refund counter address and open hours:

tax refund counter address and open hours:

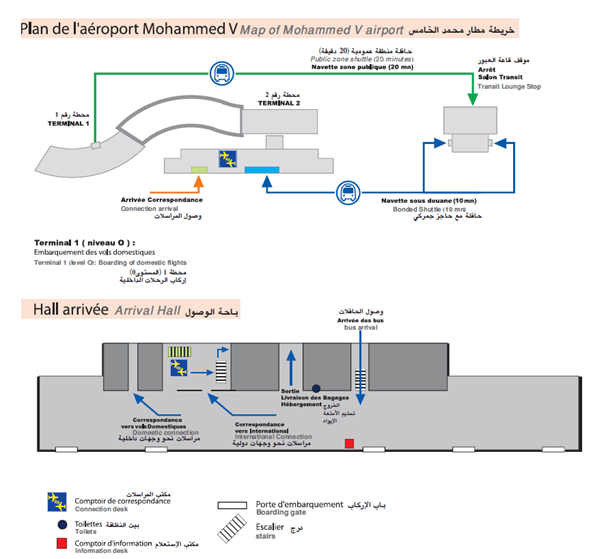

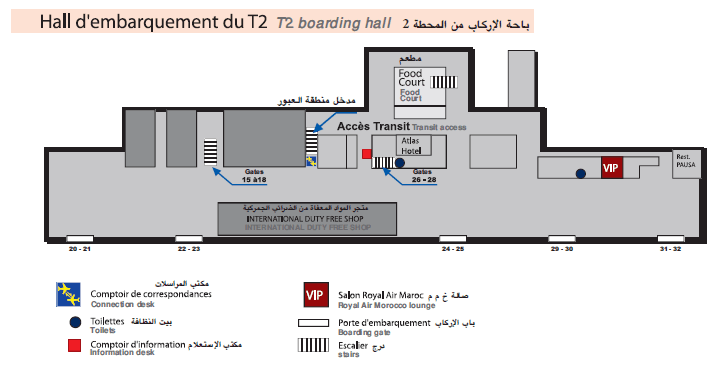

Casablanca Mohamed V Airport, Terminal 2 - Departures, 20100

Casablanca

Mon-Fri 07:00 a.m. - 10:00 p.m.

Sat 07:00 a.m.- 10:00 p.m.

Sun 07:00

a.m. - 10:00 p.m.

Marrakech-Menara Airport, Terminal 1 - Hall Public, 40000

Marrakech

Mon-Fri 06:00 a.m. 至 08:00 p.m.

Sat 06:00 a.m. 至 08:00 p.m.

Sun 06:00

a.m. 至 08:00 p.m.

Mohammed V airport map

Turkey

Turkey

UnionPay Tax Refund Steps:

1. Tax refund can be applied for any purchase over 100.00 New Turkish Lira (about RMB292.00); when completing the Tax Refund Form, please choose credit card for receiving tax refund and fill in a UnionPay card having number starting with 62.

2. If tax-free goods are within the check-in luggage, then

before going through the boarding procedure, please apply to the Customs Office for tax

refund by presenting your Tax Refund Form, passport, tax-free goods and sales slip to

the Customs Office for inspection and stamping. also if you do not have a shopping

receipt, the tax free form must indicate the product details and with the invoice number

printed in red.

If tax-free goods are within the carry-on luggage, please go

through the tax refund procedure with the Customs Office at the Departure Hall after

Security Control.

3. Post the stamped Tax Refund Form to the counter or mailbox of corresponding tax-free company.

UnionPay Tax Refund Tips:

No tax refund is available for the following goods: food (solid and liquid), tobacco, medicines, gem, transportation for private use, proprietary cultural relics.

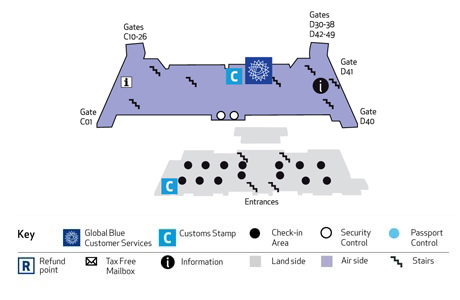

Check-in Luggage Tax Refund Inspection is near Counter A and C Carry-on Luggage Tax Refund Inspection is near Gate 219

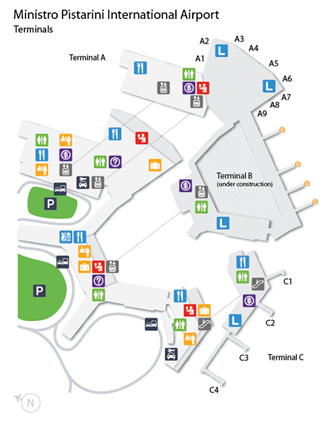

Location of Ankara Airport Refund point:

Cyprus

Cyprus

UnionPay Tax Refund Steps:

1. Tax refund can be applied for any purchase over 50.00 Euro in the same tax-free store; when completing the Tax Refund Form, please choose credit card for receiving tax refund and fill in a UnionPay card having number starting with 62 (reference tax free rate: VAT 18%; handling charge will be charged by the tax-free company).

2. Before going through the boarding procedure, please apply to the Customs Office for tax refund by presenting your Tax Refund Form, passport, tax-free goods and sales slip to the Customs Office for inspection and stamping. (Customs Stamp is opposite to the Security Control.)

3. Mail the stamped Tax Refund Form; or after Security Control, submit the Tax Refund Form to corresponding Tax-free Counter or post it into corresponding mailbox.

Global Blue, Planet, and Tax Free Worldwide all support UnionPay tax refund:

UnionPay Tax Refund Tips:

No tax refund is available for food purchased in Cyprus.

Locations of the Customs and Refund point at Larnaca International Airport:

Location of Paphos International Airport Customs:

Lebanon

Lebanon

UnionPay Tax Refund Steps:

1. Tax refund can be applied for any purchase over 150,000.00 Lebanese pound (about RMB655.00); when completing the Tax Refund Form, please choose credit card for receiving tax refund and fill in a UnionPay card having number starting with 62 (reference tax free rate: VAT 10%).

2. Before going through the boarding procedure, please apply to the Customs Office for tax refund by presenting your Tax Refund Form, passport, tax-free goods and sales slip to the Customs Office for inspection and stamping (Counter of the tax-free company is opposite the Passport Control; Customs Stamp is on the right of Tax-free Counter).

3. Post the stamped Tax Refund Form to the counter or mailbox of corresponding tax-free company.

UnionPay Tax Refund Tips:

No tax refund is available for food, beverages, gem, jewelry and ornaments.

Locations of the Customs and Refund point at Beirut-Rafic Hariri International Airport:

Malta

Malta

UnionPay Tax Refund Steps:

Standard VAT rate 18%; books, pharmaceuticals 5%. Actual tax refund value subject to amount spent and Terms and Conditions.

Tax refund service is available to Non-EU residents. The minimum purchase amount for tax refund is 100 Euro per individual receipt.

Purchase date does not exceed 90 days from the date of departure. Theoretically, a tax refund form stamped with a valid customs seal is valid for three years from the date of issuance of the tax refund form.

When leaving the country, please show the sealed and unused goods, tax refund form and shopping receipt to the customs, and ask the customs officer to stamp the customs seal on the corresponding place of the tax refund form. Do not consign the goods for customs inspection until they have been stamped by the customs. A tax refund form without customs seal shall be deemed to be invalid.

After returning to China, you can apply for tax refund service with the tax refund form with customs seal, shopping receipt and personal passport. Note: please come here in person.

UnionPay Tax Refund Tips:

-

Required for customs approval: fully completed tax free form

purchased goods and receipts Passport and travel documents

Required for customs approval: fully completed tax free form

purchased goods and receipts Passport and travel documents

-

If you receive a City Cash refund in your shopping destination, you must get your Tax

Free form approved by Customs and return it to Planet within 21 days and the original

store receipt or your credit card used for guarantee will get charged.

If you receive a City Cash refund in your shopping destination, you must get your Tax

Free form approved by Customs and return it to Planet within 21 days and the original

store receipt or your credit card used for guarantee will get charged.

-

At the airport, please allow enough time for Customs approval

process before your flight departs.

At the airport, please allow enough time for Customs approval

process before your flight departs.

-

Make sure the goods are sealed and unused.

Make sure the goods are sealed and unused.

-

If you are departing from Malta International Airport but changing flights at another EU

airport, and if the goods you are exporting are to be checked through to a destination

outside the EU, go to Customs at the airport in Malta and your Tax Free form will be

export validated as if you were at the EU departure point.The Baltic Sea Region

If you are departing from Malta International Airport but changing flights at another EU

airport, and if the goods you are exporting are to be checked through to a destination

outside the EU, go to Customs at the airport in Malta and your Tax Free form will be

export validated as if you were at the EU departure point.The Baltic Sea Region

The Baltic Sea Region

Estonia

Estonia

UnionPay Tax Refund Steps:

1. Tax refund can be applied for any purchase over 38.01 Euro; when completing the Tax Refund Form, please choose credit card for receiving tax refund and fill in a UnionPay card having number starting with 62. (Reference tax free rate: VAT 20%)

2. If tax-free goods are within the check-in luggage, then before going through the boarding procedure, please apply to the Customs Office for tax refund by presenting your Tax Refund Form, passport, tax-free goods and sales slip to the Customs Office (near the entrance to the Arrival level) for inspection and stamping.

If the tax-free goods are within the carry-on luggage, please firstly pass the Security Control and then make a call to the Customs officer via the international telephone between Gate 5 and 7 to handle the tax refund formalities for you.

3. Post the stamped Tax Refund Form together with the sales slip to the mailbox.

UnionPay Tax Refund Tips:

-

No tax refund is available for books and medicines

No tax refund is available for books and medicines

-

As Estonia is a member state of EU, tax refund for purchases

made in Estonia can be applied for in the last member state before departure from EU.

Accordingly, if you are heading for China from Estonia, tax refund for purchases made in

other member states can also be applied for in Estonia.

As Estonia is a member state of EU, tax refund for purchases

made in Estonia can be applied for in the last member state before departure from EU.

Accordingly, if you are heading for China from Estonia, tax refund for purchases made in

other member states can also be applied for in Estonia.

Location of the Customs at Lennart Meri Tallinn International Airport:

Latvia

Latvia

UnionPay Tax Refund Steps: