UOB and UnionPay International (UPI) have revamped its UOB UnionPay Card as a simple, no-frills card. The UOB UnionPay Card offers a 2% cash rebate on local and overseas spend1, with no minimum spending restrictions, enabling customers to reap cash rebates of up to S$600 for the first year .

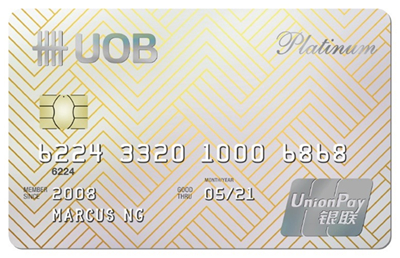

Sporting a brand new design and UnionPay’s contactless payment feature QuickPass, the UOB UnionPay Card enables Cardholders to pay for their purchases via quick tap-and-go at participating point-of-sales (POS) counters. Cardholders can take advantage of this convenient feature at local merchants such as BHG, BreadTalk, M1 and Shaw Theatres, along with overseas merchants such as 7-Eleven in Macau, SaSa in Hong Kong and Watsons in South Korea.

“The UOB UnionPay Card is perfect for those who want fuss-free rewards. It simplifies money management, and makes life easier for everyone with a simple cash rebate system. With the QuickPass contactless payment feature, Cardholders can also make payment quickly and easily by tapping their cards at participating contactless payment terminals, saving them time that can be spent on more important moments in life. This card also represents our commitment to bringing products that are tailored to the needs of local consumers, and underscores our desire to continually enhance our products and services to serve them better,” said Wenhui Yang, General Manager for Southeast Asia, UnionPay International.

Ms Choo Wan Sim, Head of Cards and Payments Singapore, UOB said: “UOB was the first and remains the only Singapore bank to offer a UnionPay credit card. In 2008, we launched our first card in recognition of the increasing travel and trade between our two markets.

Since then, our cardmembers have been using the card to make purchases in China through UnionPay's extensive acceptance network. In the last two years, we have seen a 20 per cent increase in the number of customers making purchases in China, not just for big ticket items but also for daily essentials such as groceries. UOB UnionPay cardmembers will now be rewarded with cash rebates on the purchases they make overseas and in Singapore."

In addition to receiving 2% cash rebate, new sign-ups for the UOB UnionPay Card can enjoy:

3-year annual fee waiver

New customers who sign up for the UOB UnionPay Card can enjoy a 3-year waiver of the annual card membership fee from the date of application.

More cash rebates until 30 September 2017

The first 2,000 customers who sign up for the card and whose card is approved between 26 May 2017 and 31 August 2017 can also enjoy two times the rebate i.e. 4% on all spend until 30 September 20171.

UOB UnionPay Cardholders will also be able to enjoy global offers for shopping, dining, travel and entertainment, including duty free offers at over 100 international airports around the world . UnionPay Cardholders can download the UnionPay International application via Apple App Store or Google Play Store and enjoy discounts of up to 30% at Bath & Body Works, Kate Spade, Michael Kors, TUMI and Victoria’s Secret, along with other attractive U Plan offers at Matsumoto Kiyoshi in Japan, Macy’s in the USA and King Power in Thailand among others.

In addition, the UOB UnionPay Card, a Platinum Card, entitles Cardholders to the privileges in U Collection , with global concierge services, airport VIP services and an exclusive range of dining privileges specially curated for premium Cardholders. The UOB UnionPay Card is available for sign up from 26 May 2017. To sign up online, visit uob.com.sg/unionpay