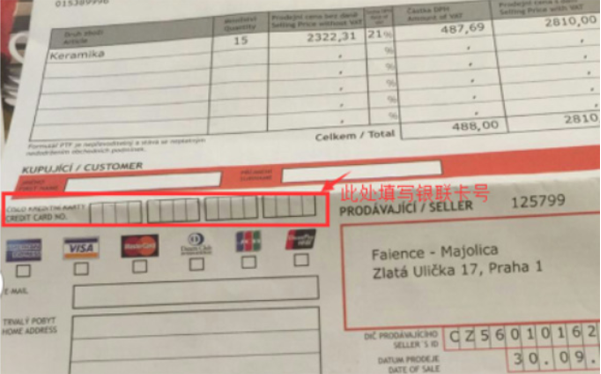

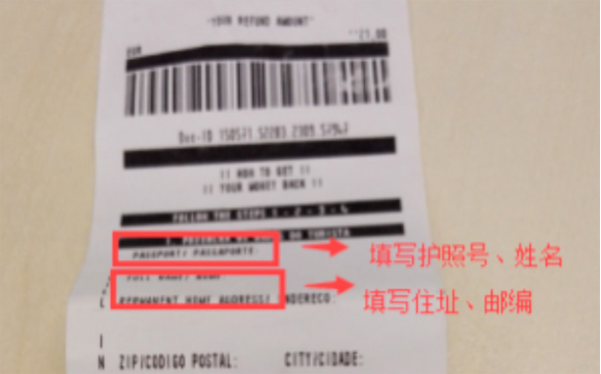

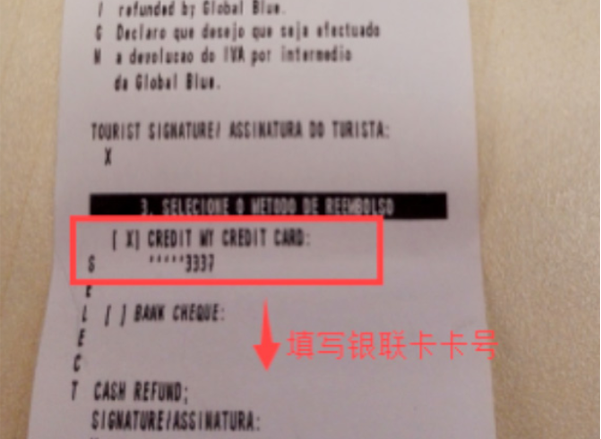

UnionPay International, in conjunction with United Money launched the service of tax refund upon returning to China. In case a UnionPay cardholder shops at any designated tax refund stores of EU countries and has its receipt for tax refund sealed by the customs, it is available to apply for tax rebate upon returning to China. The tax refund procedure is characterized by simple operation, rapid transfer and exemption from queuing. (This service is applicable for the UnionPay cards issued in Chinese Mainland only.)

Local tax refund institutions in South Korea:

You can clickthe query platform for tax refund upon returning to China, where it is available to apply for tax refund or inquire the progress and outlets of tax refund.